Do you qualify for Biden’s student loan forgiveness plan?

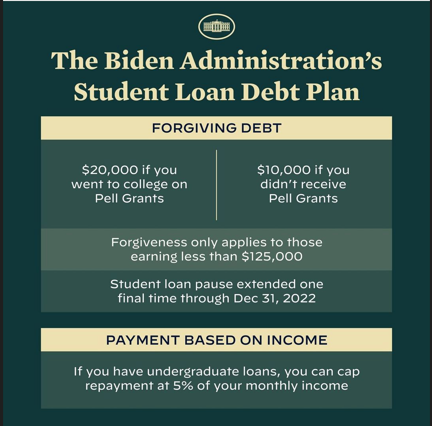

President Biden’s student loan forgiveness plan was announced August 24, 2022. There are 43 million people nationwide with student loan debt. Here is what you need to know.

Who is eligible for student loan forgiveness?

- If you have federal student loans and make less than $125,000 individually or $250,000 for a family, you qualify for up to a $10,000 cancellation.

- If you received Pell Grants, you qualify for up to a $20,000 cancellation.

What is a Pell Grant?

A Pell Grant is need-based federal financial aid that generally does not have to be repaid. The maximum Pell Grant award amount is $6,895 for the 2022-2023 school year. Pell Grant eligibility is determined by:

- Completing the FAFSA

- Demonstrating significant financial need (Example: approximately $60,000 or less family income)

Pell Grants may need to be repaid if:

- A student withdraws from classes, reducing them from a full-time student to a part-time student

- A student drops out of college during the semester or without completing the full academic year.

Will the student loan payment freeze be extended?

The freeze started in 2020, with multiple extensions, was set to expire on August 31. The payment freeze will now be extended until December 31. During the freeze, interest rates will remain at 0% until the freeze ends.

How do I apply for student loan forgiveness?

The Department of Education said “nearly 8 million borrowers may be automatically eligible to receive relief because relevant income data is already available to the Department.”

For all others, an application will be available in the near future. The Biden administration will make an announcement in the coming weeks.

Is student loan forgiveness taxable?

According to the White House, the student loan debt relief is not taxable income for federal taxes.

What if I already paid off my student loans?

The student debt forgiveness is for people currently holding students loans. However, according to the Federal Office of Student Aid, if you made payments after March 2020, during the student loan payment freeze, you can request a refund. Your loan servicer should be able to provide refund information.

What is the repayment plan for remaining student loans after debt forgiveness?

The current repayment plan is 10% of a borrower’s monthly discretionary income. A cap of 5% of a borrower’s monthly discretionary income has been proposed by the Department of Education.

What is discretionary income?

According to Webster’s dictionary, discretionary income is “income that is left after paying for things that are essential, such as food and housing.”

How is discretionary income calculated for student loan repayment?

For student loan repayment, discretionary income is calculated using a formula including the borrower’s annual income, family size, geographic location, and the federal poverty line. To help determine discretionary income, the Student Debt Relief website offers a student loan payment calculator.

What are future plans for student loan borrowers?

The Department of Education is proposing a new income-driven repayment plan to “substantially” reduce monthly payments. The proposed plan includes the following:

- Borrowers with original loan balances of $12,000 or less will receive loan balance forgiveness after 10 years, instead of 20 years, under an income-driven repayment plan. This option applies to many community college student loan borrowers.

- After the summer of 2023, student loan borrower’s will no longer have to submit income information for certification. The Department of Education will be able to automatically “pull” borrower’s income information to make recertification and enrollment easier.

- The Department of Education is looking to reduce monthly repayment amounts and interest to control student loan balance growth for borrowers who pay required monthly payments.

Is student loan debt forgiveness really going to happen?

According to The New York Times, “There is still some uncertainty about whether the plan will be implemented. Biden is enacting it through executive action because it seems to lack the support to pass in Congress, and opponents may challenge it in court.”

Special note for Maryland residents:

The Maryland Higher Education Commission offers a Student Loan Debt Relief Tax Credit for Maryland residents. Maryland residents can receive a tax credit between $875 and $1,000. For more information, check out How to apply for Maryland’s student loan debt relief tax credit.